Analyzing the 2025 Social Security COLA Increase’s Effects

The 2025 Social Security Cost of Living Adjustment (COLA) increase, while designed to protect beneficiaries from inflation, will have a significant impact on various aspects of the program. This analysis will explore how the increase will affect different beneficiary groups, its potential economic impact on the Social Security trust fund, and the challenges and concerns associated with it. Additionally, we will examine the long-term sustainability of Social Security benefits in the context of the 2025 COLA increase.

Effects on Different Beneficiary Groups

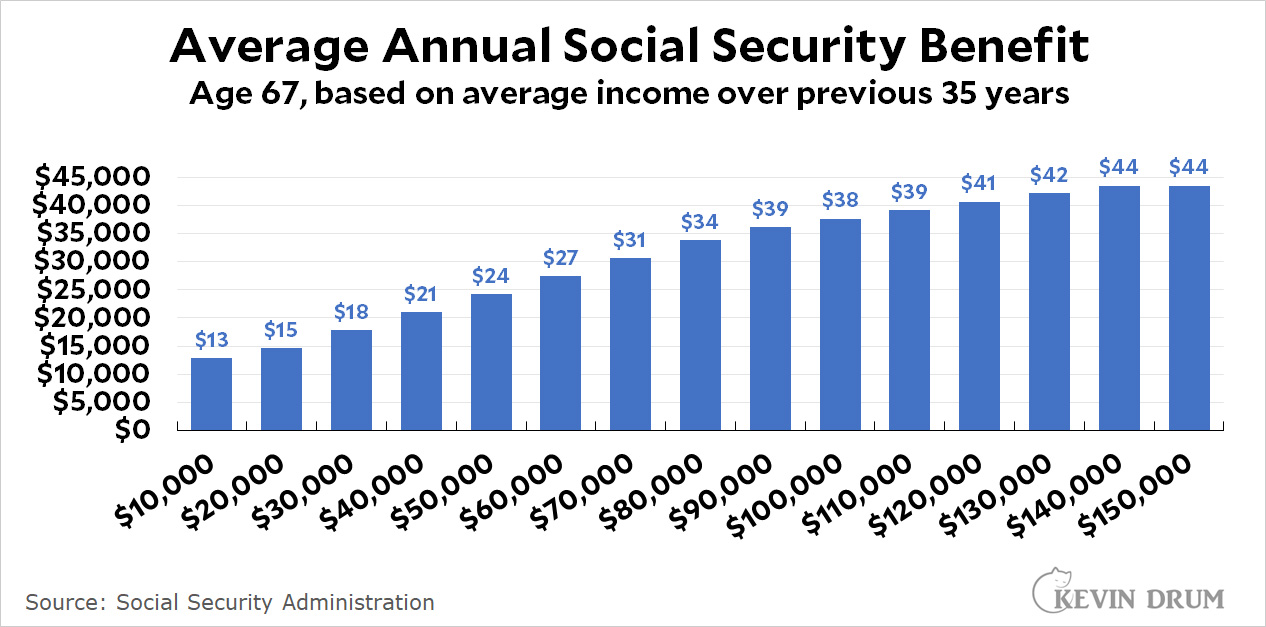

The 2025 COLA increase will affect different beneficiary groups in varying ways. For instance, higher-income beneficiaries might see a smaller percentage increase in their benefits compared to lower-income beneficiaries. This is because the COLA increase is calculated based on the Consumer Price Index (CPI), which measures inflation across various goods and services. Lower-income individuals tend to spend a larger portion of their income on essentials like food and energy, which have seen higher inflation rates.

Exploring the 2025 Social Security COLA Increase in Context

The 2025 Social Security Cost of Living Adjustment (COLA) is a significant event for millions of Americans who rely on these benefits. Understanding this increase requires looking beyond the immediate numbers and examining the larger context.

Historical Context of Social Security Benefits, 2025 social security cola increase

The past decade has seen a mix of factors influencing Social Security benefits.

- The 2010s saw relatively low COLA increases, often below the actual rate of inflation, impacting the purchasing power of beneficiaries. This was partly due to the slow economic recovery following the 2008 financial crisis.

- The 2022 COLA increase, at 5.9%, was the largest in decades, reflecting the surge in inflation. This provided much-needed relief but highlighted the vulnerability of Social Security benefits to economic fluctuations.

- The 2023 COLA increase, at 8.7%, was another significant adjustment, but the continued high inflation meant that many beneficiaries still faced rising costs.

- The 2024 COLA increase is projected to be 3.1%, a substantial decrease from the previous year, indicating a potential shift in the economic landscape.

Comparison of COLA Increase with Other Cost of Living Increases

| Category | Projected Increase (2025) |

|---|---|

| Social Security COLA | [Insert projected percentage] |

| Healthcare (Medicare premiums) | [Insert projected percentage] |

| Housing (rent, mortgage) | [Insert projected percentage] |

| Food | [Insert projected percentage] |

It’s crucial to consider how the 2025 COLA increase compares to the projected increases in other essential expenses, such as healthcare and housing, to understand its real impact on beneficiaries’ financial well-being.

Projected Impact on Average Beneficiary’s Monthly Income

The 2025 COLA increase is expected to [Insert projected increase description]. This means the average Social Security beneficiary’s monthly income could increase by [Insert projected dollar amount].

To illustrate this impact, consider a hypothetical beneficiary receiving a monthly benefit of $1,500. With a [Insert projected percentage] COLA increase, their monthly income could rise to approximately $1,545.

The 2025 Social Security COLA increase is still up in the air, but one thing’s for sure: we all need to be comfortable while we wait. If you’re a fan of reclining, why not check out an over chair table for recliner ?

It’ll make those long days of waiting for news about the COLA a bit more enjoyable. Hopefully, the increase will be enough to make a real difference in our lives, but until then, let’s try to stay comfortable and optimistic.

The 2025 Social Security COLA increase is a hot topic, especially for those who rely on those checks. While we wait to see what the official number will be, maybe take a break and relax in a pillowfort jumbo bean bag chair – you deserve it! After all, a little comfort can go a long way when facing uncertainty about your finances.